Life360 Long Thesis

How a change in offerings for a freemium consumer app with strong organic customer acquisition advantages could increase its TAM and improve retention to drive higher LTVs

About

Life360 (ASX: 360) is the maker of a mobile, location-based family management application. The company’s eponymous mobile app offers families and their members location tracking/history, driving reports, crash detection alters, stolen phone coverage, SOS help alerts, a 24/7 hotline for emergency dispatch, crime alerts, and ID theft protection.

The company utilizes a freemium model to onboard users where it upsells them to subscription tiers with premium features. In addition, the company generates revenue through partnerships with insurance and home security companies and through data licensing agreements.

Life360 was founded in 2007 and is headquartered in San Francisco. The company is listed on the ASX; its financials are reported in USD.

Narrative and Thesis

Generally, new age consumer businesses that own their product are difficult to invest in. In consumer facing SaaS, at best you retain 100% of your previous year spend from a customer (Spotify, a service that differentiates itself through a superior UX, good recommendation engine, and now exclusive content, has 72% 3-month and 65% 1-year retention of paying customers). Often, these companies are competing against free/included offerings from large companies looking to add value to their ecosystem or bundle. Even worse, in direct-to-consumer physical goods, a company realizes diseconomies of scale as the initial customers are the cheapest to acquire. As a company’s messaging or product-market fit experiences decreasing returns (through return on performance ad spend) amongst a greater universe of potential customers, the savings generated from bypassing wholesale and selling online soon gets redistributed to Facebook or Google. To guarantee unit economics, the product is introduced in retail amongst a shelf of legacy competitors, five other DTC brands, and Target’s private label version. Despite these unfavorable characteristics, a select few new age brands generate outsized returns. Some combination of stronger customer loyalty, a better value proposition, and/or superior user experience leads to some an above-average monetizing of the customer lifecycle. The levers a consumer facing SaaS management team can pull on is quite simple and we believe Life360 has favorable trends in all three areas: sales and marketing to acquire new users, research and development to introduce new monetizable features, and initiatives to increase customer lifetime value through better retention, increased average revenue per user, and a superior user experience.

What we hope to show with Life360 is that management’s recent initiatives to pull on these levers will be reflected in its financials over the coming years.

First, the company has introduced new features. The market for these features are currently dominated by point solution providers at a higher or equal price. We will show that Life360 can offer a bundle of services with equal or superior value to competing solutions at a fraction of the sum of the parts.

Second, the company is revamping its funnel. Traditionally, Life360 acquired users through a freemium model. That is, the company would acquire free monthly active users (MAUs) to download its app and sign up. Through user education and banner ads inside the app, Life360 would attempt to upsell family units to paid offerings which included features such as Driver Reports (was my teenage driver braking too hard or accelerating too fast, speeding, etc?) and longer Location History. Because users use the app on iOS and Android, Apple or Google received a percentage of all subscription fees signed up through the app (30% on year 1 revenue, and 15% thereafter). By mid-2021, the company will market to prospective subscription users through digital performance channels where it will direct them to the Life360 website. Once a user is on the website, the company can educate them on Life360’s new features, start them on a free trial, and take their credit card information for purchasing the subscription outside the app store. This presents margin upside while limiting friction as the old funnel and subscription offerings will still be available in-app. Upsells through the app will still be subject to Apple’s tax (this report will refrain from any discussion of possible upside from ongoing legal battles against Apple or Google’s gatekeeper status), but the company will enjoy 22% higher contribution margin on direct-to-consumer (DTC) sign ups.

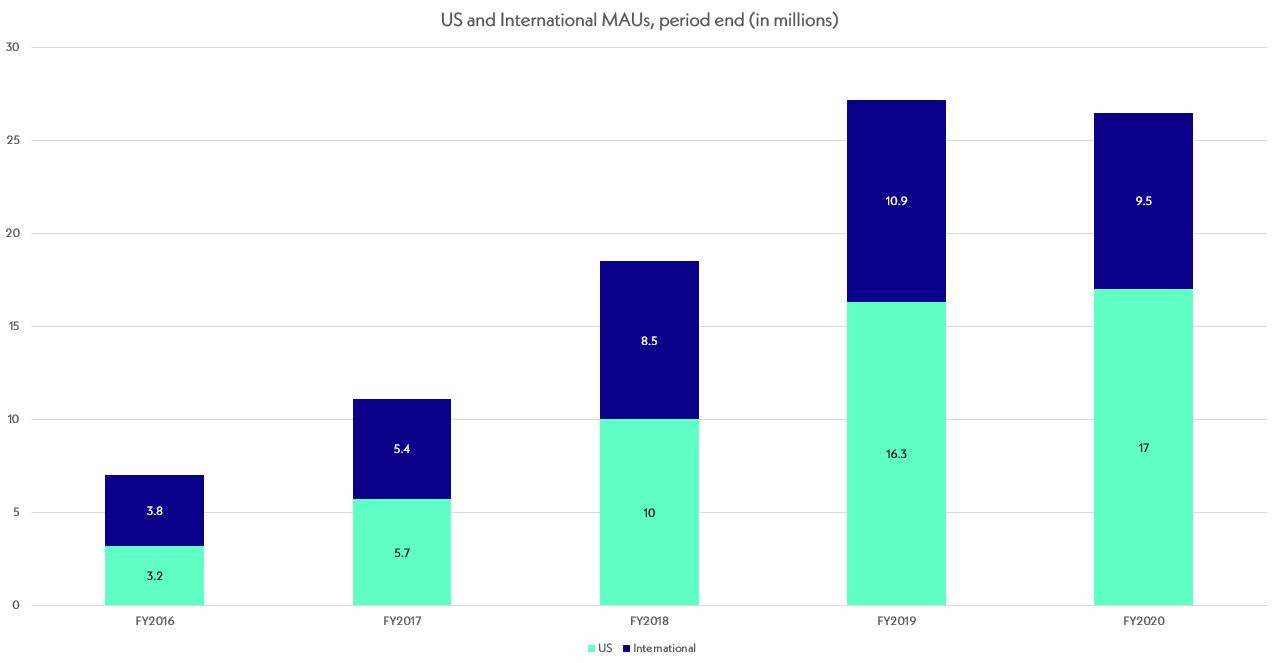

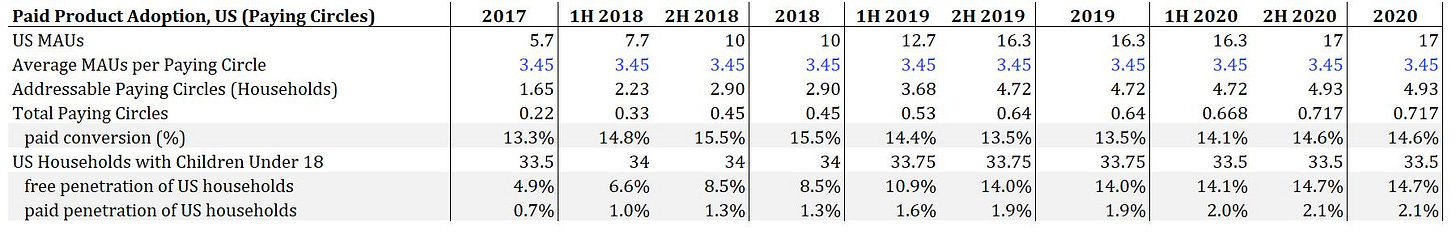

Third, we believe the company is largely underpenetrated in its target market of households with children under 18 and has a long runway in acquiring more families and converting free families to paying customers. Today we estimate the company has grown its total penetration (both free and paid US MAUs) from 4.9% of US households with children under 18 in 2017 to 14.6% in 2020 with paid penetration increasing from 0.7% to 2.1% over the same period. While we find research (explored in later sections) that only 10% of parents in the US are “helicopter parents”, we believe the offerings Life360 is adding outside of its core location and driving report features will add meaningfully to the length of time a family utilizes the app and increase retention dynamics.

As we explore in later sections, the chief variable in adding value is management’s return on capital – regardless of whether this is an enterprise PaaS company where a customer increases their spend 35x over five years or a consumer facing mattress company. Acquiring customers profitably, investing in R&D to increase monetization opportunities, and investing in customer success to increase the customer lifecycle is the ultimate driver of value. In fact, we believe that with lower competition in a “boring” industry a company can enjoy superior returns on capital to those in more “desirable”, but competitive industries. We do not ignore the risk that others (including big tech) may see Life360’s industry as an opportunity to add value to their ecosystems and begin to compete away the superior unit economics the company possesses. But despite low barriers to entry, Life360 today has created a strong ecosystem of parents (we estimate around 14% of US households with children under 18 are currently monthly active users, up from under 5% three years ago) who currently use the app. As the company adds high perceived value features for fractions of the cost of competing point solutions while extending the customer lifecycle, there is recipe here for strong value proposition design leading to outsized equity returns in an unglamorous industry. During this period, we believe Life360 could establish its product as an extremely strong value proposition with word-of-mouth adoption (which it already enjoys) forming a strong moat. Ultimately, we believe Life360 is well positioned to be the premiere platform to manage and protect your family – a single source of truth about the status and safety of your family.

The majority of this analysis and thesis is US focused as we believe they company would be best to focus on maximum capture and monetization of the US market. Though we do recognize value in international expansion, we believe the opportunity in the US should be the strategic priority for the foreseeable future given the runway.

Key Points & Risks to our Thesis

We see value for Life360 in:

Increasing penetration of US households with children under 18

Life360 has increased its MAU penetration of US households with children under 18 from 4.9% in 2017 to 14.7% in 2020; the company’s new offerings and strong brand recognition among parents presents a compelling runway for the company to expand families on the platform and sell them into high perceived value offerings

Potential short and long-term inflections in the business:

We believe the company’s new subscription offerings provide an extreme value premium versus competing point solutions which should allow the company to increase its conversion of free users to paid subscribers

New initiatives around DTC marketing for their paid efforts will dramatically change the funnel for paid customers and increase margins

While this presents execution risk, its DTC funnel will help with customer education around the new features Life360 has to offer while providing gross margin leverage as the company shifts from Apple and Google’s 30% fee (15% after year 1) to the 3% fee from an entity like Stripe or Recurly

We do not believe this adds friction to the traditional freemium-to-upsell funnel that takes place in-app since users will still be able to upgrade in-app; instead, we believe this offers an enticing opportunity for the company to focus its customer acquisition efforts on high value subscribers from the outset of the relationship

Higher average revenue per family among new families from the new subscription tiers vs old model

If the company can reach feature parity with competing point solutions, it will benefit from higher initial adoption (given the bundle costs significantly less than the sum of the parts) and the superior retention behavior of those solutions will increase the lifetime value of Life360’s customers

For example, Life360 currently has 51% retention among paying families 1 year after purchase. LifeLock, in contrast, has 85% annual retention.

Optionality in TAM expansion from households with children under 18 to all US households making over $50,000/year by way of new feature additions could extend the lifecycle of a customer

We currently view the company as having an 8-12 year lifecycle at best (a child gets a phone when they are 10-12 and the location tracking features are not useful to parents past 18-22); if the company’s new solutions can address a broader set of family related issues (such as credit monitoring, identity theft protection, roadside assistance, 24/7 help) at a significantly lower price with a superior user experience, there is ample room to expand its TAM and customer lifecycle

Technical factors such as

A US listing, leading to valuation arbitrage of US listed vs ASX listed technology companies

Additionally, the resulting forced buying by Russell 2000 and growth indexers

We see risks stemming from:

Strategic investments by large technology companies into the family management space

iOS 14

The data licensing business (24% of revenue) may be affected by low opt-in rates to external data sharing

AUD/USD risk for US investors

Rising customer acquisition costs/payback period may lead to worsening unit economics

If the customer fails to perceive value in Life360’s new and current offerings and the company has maxed out the “low hanging fruit” of helicopter parents who currently use the service, past financials reflect customer acquisition costs for users where the company had its strongest product-market fit. Going forward, CAC could rise significantly leading to significantly lower customer level IRRs

Or, Life360 management realizes the significant uplift in customer LTV of its new offerings and decides to bid up on CAC (i.e. is willing to accept the same payback period or LTV/CAC ratio), but cohort/user behavior trends along historical paths and these LTV assumptions do not get realized. As such, the company has acquired cohorts that will never be profitable.

The concise bearish thesis is:

Life360 is tapped out in the US in terms of “helicopter parent” penetration and will struggle to convert the other 85% of households with children in the US

The company is enacting initiatives to make the app more monetizable through feature additions that are typically offered by point solutions and will not be able to land or upsell new users since these services are typically offered by more trusted and well established players

Teenagers hate the app and can scheme to present false location data through fake GPS apps, rendering the flagship service ineffective and causing parents to churn

Company

History

Founded in 2007 by Chris Hull and Alex Haro, Life360 began to help track the movements of family members. Hull and Haro envisioned the app after witnessing the difficulty families had reconnecting after Hurricane Katrina.

Traction was slow to start. At the outset, Life360 was only available on Android and location sharing via mobile had widespread privacy concerns among potential users. In the early 2010s, growth exploded. By 2013, the service had 34mn MAU (eclipsing the popular location social network Foursquare) and had raised $20mn from Bessemer, Seraph Group, Fontinalis Partners, 500 Startups, BWM, ADT Security, and DCM Ventures1. At the time, Apple and Google both offered similar apps. Apple with its Find my Friends app and Google with its now defunct Latitude (shut down in August 2013). CEO Chris Hull attributed Life360’s success over Latitude to their focus on serving the niche of families versus Google’s lowest common denominator platform approach2. In addition to competition from big tech, many other startups entered the family networking scene. Hubble, introduced in 2013, was a family messaging app offering text messages, photo sharing, voice messages, location sharing, and alerts; Alert.Us was a similar app was founded in 2011 but ceased operations in 2014.

Also in 2013, the company introduced monetizable features. For $4.99 per month, the company offered users a 24/7 Live Advisor, unlimited geo-fenced places for location-based alerts (i.e. Child A has arrived at school, work, etc), and expanded phone protection. At the time, more than half of the company’s users were overseas. In its 2014 Series C, the company raised $50mn from ADT and others to help ADT develop a new mobile application with direct access to ADT’s 24/7 monitoring centers.

The company went public in May 2019, raising $112.7mn AUD (note: the company is listed in Australia but reports its financials in USD; any financials mentioned throughout the paper are in US dollars unless stated otherwise). The company chose to list in Australia given its first investors were based in the country, the unfavorable terms typically given to founders of late-stage US startups, and rising demand for more tech companies on the ASX3.

Today, the company primarily does business in the US where 86% of its revenue and 60% of its monthly active users (MAUs) are located. Life360 still utilizes a freemium model to acquire users and hope to upsell them to subscriptions.

The app is not popular among teenagers, however. In 2020, a viral TikTok trend encouraged teens to leave bad reviews for Life360 on the Apple App Store and Google Play Store. The company reached out to Apple and Google and was able to remedy the issues; today it has 4.5 stars on the App Store and is the 9th ranked free app in Social Media. Lastly, various online message boards give users tips on how to install fake GPS apps and procure burner phones to circumvent parental tracking.

So why is Life360 still around when many other upstarts and apps from major technology companies came onto the scene? To be fair, the road for Life360 has not been easy. The early and mid-2010s presented a significant competitive threat to Life360 and the company’s 2016 MAU count of 7mn was significantly lower than the reported 33mn MAUs in 2013. At the time, VC investment in social companies and mobile apps was significantly higher than it has been in the past 5 years as the mobile ecosystem matured and an understanding of the unit economics has become well known. For example, the social app Foursquare had raised $112mn in its first 4 years of business (2009-2013) before its mobile offerings became less relevant among consumers. Recent social apps are mostly bootstrapped startups and must demonstrate significant traction and product-market fit before getting funding. Tbh, the teen social app focused on positive anonymous messages, rose to 2.5mn DAU in nine weeks before being acquired by Facebook for $100mn4. The company behind the app took a small seed round of $3.5mn in 2013 and had 14 failed projects before tbh took off5. Clubhouse, the newest social craze, began with a $10mn Series A from Andreesen Horowitz in May of 2020 before raising an additional $100mn in February 20215. Twitter has copied Clubhouse’s functionality with Spaces while Facebook is said to have a copy in the works6,7. To conclude, venture funds are less willing to fund family-based mobile applications today than at the height of the mobile app boom in the early 2010s. The lack of network effects, low switching costs, and majority mix of free users utilizing these services make it a challenged industry. We believe Life360 has passed peak competition and is set to continue differentiating its value proposition against free versions from large tech companies and competing point solutions.

Current & Past Offerings; Monetization

Life360 employs a freemium model where families can always utilize a free version of the app. The company offers subscription plans that provide additional features.

The free version of Life360 includes 2 days of location history for each family member, 2 place alerts where family members can set up geofenced areas around POIs, family driving summaries, crash detection, and SOS help alerts. The company offers subscriptions to families wanting additional location history, crime reports, individual driving reports, stolen phone coverage, credit monitoring, family safety assistance, and identity theft protection. The company offers a seven day free trial to users wishing to try their subscription offerings.

Life360 had two legacy subscription products until July 2020. Life360 Plus, a $2.99/month service, included 30 days of location history (versus 2 days in the free version) and crime reports. Driver Protect, a $7.99/month offering, added texting while driving alerts, sudden acceleration/hard braking alerts, roadside assistance (similar to AAA), crash detection, ambulance dispatch, and weekly driving reports.

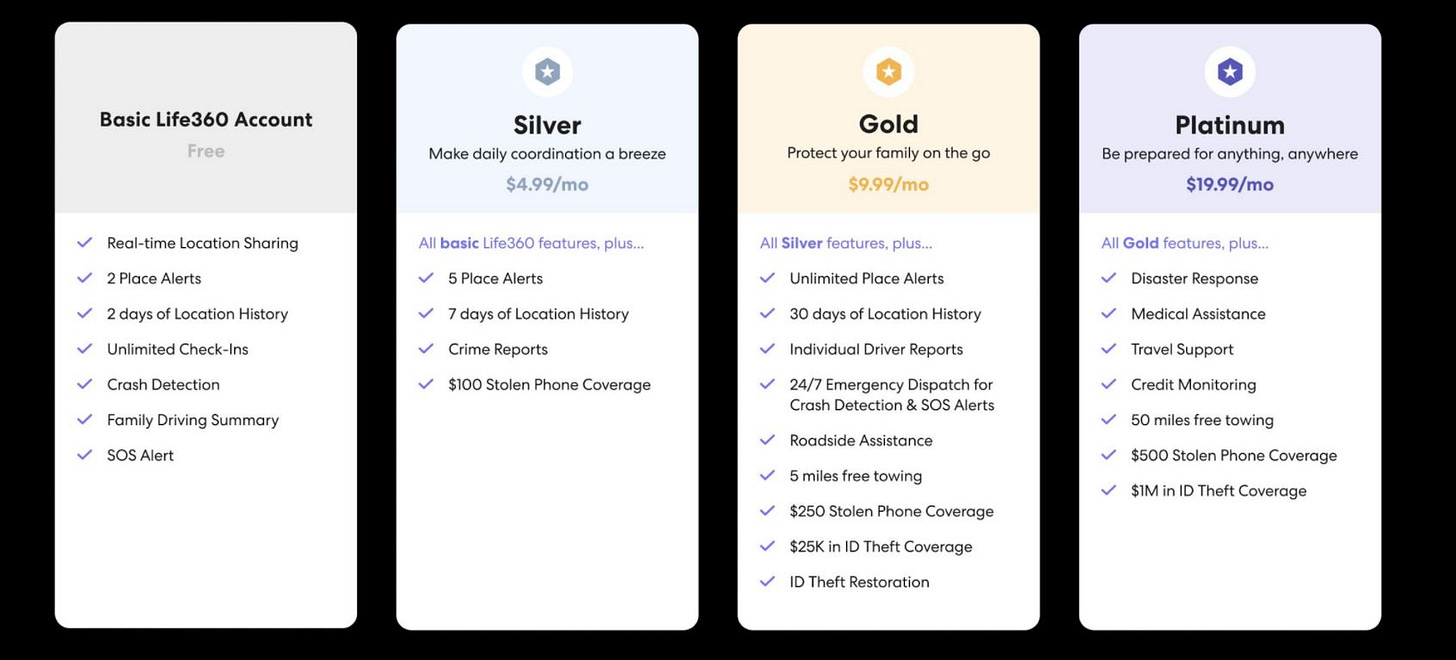

In July 2020, the company introduced new subscription tiers. The new offerings were the culmination of R&D investments from the 2019 IPO proceeds and the company’s vision to create a comprehensive offering that a family would typically procure from 8 to 10 point solutions under one subscription for a fraction of the cost. The company expanded to three tiers: $4.99/month for the Silver Tier, $9.99/month for the Gold Tier, and $19.99/month for the Platinum tier (there is a 17% discount if billed annually).

Management highlighted three major product changes. First, an SOS button anchored on all screens allows a user in distress to send alerts to their family members and emergency contacts saying they are in danger; a 24/7 emergency dispatcher can then send needed assistance (the company sent out over 10,000 ambulances in 2019)9. Second, Family Safety Assist Agents were introduced to help with urgent matters that are not emergencies. For example, a family in a foreign country in need of medical advice on where to go can talk to their customer support team and a nurse at any time. Third, the company introduced Identity Theft Protection.

Previously, Life360 was focused on physical and driver safety; now, the company sees opportunity in digital protection for the family. At sign up, an entire family’s credit, passwords, accounts, and information can begin being monitored. With this introduction, Life360 is beginning to compete against well established, billion-dollar companies. However, they see opportunity in offering a holistic bundle for 10% of the cost.

A detailed view of the tiers:

Exhibit 1: Life360 Subscription Offerings, July 2020 Membership Launch Briefing, Slide 17

In addition to new features, Life360 management built out their lifecycle marketing team. The new membership tiers required customer education/reeducation and upselling opportunities in-app. Furthermore, the new features opened the possibility for direct-to-consumer (DTC) performance marketing. Previously, Life360 would upsell free users in-app to higher tiers to unlock greater insights about their child’s location history and driving behavior. Going forward, the company’s offerings around roadside assistance, stolen phone coverage, identity theft protection, and 24/7 SOS response enable greater opportunities to educate prospective users about the value add Life360 can provide for a family unit beyond generic location insights. We believe this radically changes the funnel characteristics and TAM for Life360. We explore this in later sections.

During the new subscription investor briefing, Life360 management noted the unit economics would be similar at 90% gross margins ex app store commissions with gross margins dollars being up as well. With outside assistance, the company conducted a three-month study with thousands of interview around what “killer features” the company could command pricing on versus what features head of households already got elsewhere. In one instance, they raised their roadside assistance offering to 50 miles of free towing from 5 miles previously to reach feature parity with AAA. Management commented that most users do not use these services or ever need a 50-mile tow, but it is a nice-to-have and has high perceived value (we mention “high perceived value” several times throughout the paper; in general, we are referring to a feature/product that the customer values highly but may not be used much or cost much to offer). Life360 outsources actuarial risk and does not have risk relating to $1mn identity theft payouts; this is a fixed cost to the company.

Life360 believes their pricing is extremely competitive. The company can offer feature parity at a fraction of the price of competing point solutions (a copy of its Platinum subscription would cost $256/month from competing vendors per its investor presentation). Management attributes this low pricing to their strong funnel dynamics and low CAC. While LifeLock pays $250 to acquire a single customer, Life360 acquires users for pennies and dollars. This advantage accompanied with their software-first offering provides what we believe to be a unique advantage. We will explore in alter sections how this should allow the company to: a) acquire paid users directly through strong messaging on social channels and onboarding on their website (bypassing app store fees); b) expand the lifecycle of a family using the app (no longer is it just relevant for parents of teenage and college kids), increasing customer lifetime value (LTV) all else equal; and c) increase its TAM to all families, not those with just teen and college aged children.

Lastly, for modeling purposes we should note that legacy Driver Protect Paying Circles (Life360’s definition for number of families that are paid subscribers) are grandfathered into the Gold tier at legacy prices.

The company defines its subscription revenue as “Direct Revenue” but generates additional “Indirect Revenue” from partnership activities. The company’s indirect revenue efforts include partnership revenue from ADT and Allstate in addition to data sharing agreements with other parties. The United States accounts for 86% all indirect revenue where the company receives on average $1/year per MAU. Life360’s international indirect revenue efforts began in the second of 2019; the company averaged $0.34 per international MAU in 1H FY2020.

Life360 has rich location and driving data. Per the IPO prospectus, Life360 has 650TB of location data including 85bn location points and 12.5bn driving miles logged. Though the company currently does not have a built-out ad product, they do have the option to present contextually relevant advertising. For example, the company currently has unique insights into when a user registers a new phone, is in the process of moving (they can cross reference location visits with active MLS listings), and when a family is traveling.

The ADT and Allstate partnerships involve technology licensing and advertising placement. ADT pays to license Life360’s technology for its integrated mobile application ADT Go. ADT contributed $654k in revenue in 2019 and $1.976mn in 2018. Allstate licenses its technology in order collect, process, and analyze driving behavior. Additionally, Allstate pays for in-app advertising with custom rates based on user driving behavior. Allstate contributed $4mn in indirect revenue in 2019 and just over $500k in 2018.

We view the biggest risk to indirect revenue streams as iOS 14. Per the company’s privacy policy, no personally identifiable information is shared – only anonymized driving scores and location information is shared. However, we do not view indirect revenue as the main driver of value for Life360 long term but do model in various scenarios in our valuation.

Value Proposition

We believe Life360’s value proposition has materially changed in the last 12 months and significantly against the original and core location feature set. During the initial years after launch, Life360 was a first mover. It was the first to offer location insights on family members and benefitted as such. The market for consumer-focused mobile applications became competitive – both from startups and the platform companies. Mobile smartphone penetration in the US – and specifically iOS usage amongst teenagers – due to the introduction of lower priced models likely contributed to declining user numbers as Apple’s integrated Find my Friends app was a perfectly acceptable and frictionless substitute to Life360’s free version. Apple had essentially rendered Life360’s core location finding features as generic as the original flashlight apps.

However, with its new services, Life360 has pivoted to offerings that are differentiated against generic software replications of location functionality. Life360 can price and bundle new features much lower than legacy point solutions. We believe the company’s value proposition has shifted from a generic family location monitoring app with driving reports (that are not relevant to many parents) to a family safety and security bundle of services families would traditionally get through expensive point solutions. In later sections we discuss where Life360 has feature parity with competing solutions and where they fall short.

Users, Paying Circles, & the Acquisition Funnel

Life360’s userbase consists of free and paid users. The company reports users by geography (US and international) based on monthly active users (MAUs). MAU disclosures are inclusive of paid users. The company also reports Paying Circles. Paying Circles are family units that are paid subscribers. Per the IPO prospectus, there were 3.45 users per paying circle in 2018. The company does not report gross user additions in any period but does provide some color on typical retention patterns. We discuss retention of free and paid users/families and conversion rates in the Cohort and Customer Behavior section, but free user retention is in the low to mid 30s after 18 months while paid retention is 59% after 12 months.

The current acquisition funnel is simple. The company acquires free users to its app through word of mouth or paid advertising. After the user is acquainted with the free version of the app, the company attempts to upsell users to paid tiers in-app; users in lower tiers are marketed higher tiers. Because many of the location and driving centered features are relevant only to parents of teenage adults, we define the legacy TAM for this US focused analysis as US Households with children under 18 (as previously noted, as value-oriented investors we do not wish to assign a large optionality value to the company in markets where the company is not devoting the majority of its strategic resources; i.e. a 50bp capture of developed households with children under 18 could easily garner a significant but undue option value). This funnel implies that currently the company has some blended CAC it pays to acquire free users. Some free users then convert to paid users (giving us an imputed CAC for paid users) and are monetized by the company. We mention blended CAC because the company benefits from strong brand recognition and word of mouth downloads. In 2018, 77% of new users came to the app organically from brand awareness or word of mouth (greater than 50% were word of mouth). Management commented that brand awareness among US parents with children under 18 was 29% in 2018. This is evidenced, by its Top 10 Free App status in the Social Networking category of the Apple App Store (and 83rd ranking overall).

The lifecycle of a family on the app is limited. At best, a paying family with Life360 uses/buys the service when their child receives their first smartphone around age 10 to 12 and has little use once the child graduates high school or college. In short, Life360’s best users only use the app for 10 years at max. While there are always new families with children in the US replacing soon-to-be empty nesters, having to reacquire 10% of your user base (1 divided by a 10-year useful life gives us 10% steady state lifecycle churn) every year at scale just to hit breakeven user growth is not a great business model as initial user acquisition is expensive. Management’s introduction of new features that are useful regardless of user age, is a powerful addition. A main pillar of our thesis is the positive attributes transforming the funnel and lifecycle components stemming from the new feature offerings. If the marketing team can provide a compelling message on why a customer should get identity theft protection, roadside assistance, and family safety assist from Life360 the company can increase its TAM beyond parents of college aged kids, lengthen the lifecycle of a paying family, and dramatically increase retention.

Cost Structure Overview

As a software offering, Life360 enjoys software like technology costs. Several of the services Life360 provides are contracted, outsourced, or de-risked to the company for a fixed cost per paying user. Contribution margins on paid users, which include the cost of paying commissions to Apple and Google on in-app subscriptions (currently the only way to subscribe is in-app) and the cost of servicing free users, are between 40-45%8. Although we believe that a majority of users in the future will still be onboarded through the app (via word of mouth, brand awareness, or the app’s top 10 position) and will convert through the app, the new marketing DTC marketing funnel will lift contribution margins by 22% on average per DTC user (Apple and Google charge 30% on the subscription in year 1 and 15% thereafter). Inclusive in the contribution margin calculation are customer support and service costs (~3% of revenue) and technology costs (~19% of revenue). To support its 24/7 live support offerings, the company employs a call center in Las Vegas and Honduras as well as a shared call center for emergency response services through Avant Guard Monitoring in Salt Lake City. In December 2018, the company received 22,500 call inquiries and 527 collision detections. The contribution margins realized allows for significant operating leverage at any time if the company wished to pause investments in user acquisition. During a significant pullback of user acquisition spending in 2020, the company was FCF positive.

The company segments marketing spending into a generic sales and marketing bucket and user acquisition spend bucket. We discuss in later sections historical user acquisition costs and our view on brand marketing long term. Research and development efforts by the company improve the user experience (UX) and introduce new features which can either be monetized or contribute to improved retention. The majority of the company’s 170 employees work in research and development. Finally, Life360’s general and administrative spend covers management, accounting, and clerical personal.

Employee Data

At the time of its IPO, the company had 103 employees. 80 of whom worked in product development, 14 in G&A, and 9 in marketing. As of Q1 2020, the company had 170 employees. Given its location in San Francisco, the company competes against other tech firms – large and small – for engineering talent. During its first quarter 2020 call, management mentioned they saw an increase in candidates from prominent companies in the valley with negative unit economics and feel they offer a strong compensation package.

Stock based compensation has trended around 8-10% of revenue in the periods since going public.

COVID Effects & Other Recent Events

Until March 2020, Life360 experienced growth above expectations but new user growth diminished during the onset of COVID shutdowns. The company saw new registrations normalize at levels down 50% y/y during the quarter. As a result of shutdowns, the company paused user acquisition spend. The company added 900k net MAUs in the period and 35k Paying Circles. By the second quarter, MAUs had declined but were back above December 2019 levels in the US but the company saw challenges from Google’s ban of Android for Huawei phones which are popular in key international market. This ban led to a 2.5mn decline in international MAUs during the quarter. Paying Circles were down 17k sequentially in Q2. Amidst the pandemic, the company launched its new subscription offerings in July. The company saw strong uptake with 40k upsell and new subscribers in the first month (which does not include subscribers grandfathered in). In addition, it added new features for teens to have more privacy; parents can select a perimeter for their child to stay within and will not be alerted to their exact location unless they breach the perimeter. For the third quarter, MAUs increased sequentially by 500k. Paying Circles increased to 884k, above the previous highs in March. Life360’s subscription offerings continued to exhibit strong uptake with 93k new and upsell subscribers to date (the Q&A portion of the call noted the majority of these were new adds, not upsells). Management commented on the Q3 business update call that CAC has been a struggle during the pandemic as stay-at-home apps have bid up mobile application ad rates and the lack of real-world use cases (kids not going to school/out with friends) was hurting their funnel. To cap off the year, the company again saw MAUs increase sequentially by800k. Paying Circles increased by 5k while the company counted 152k new and upsell subscribers in its new membership tiers since launch. During the quarter, the company signed a partnership with Google to bring voice assistant features to Google’s products. Management commented they have signed NDAs with other large companies on partnership opportunities.

Of note, management mentioned the possibility of a US listing in the Q4 2019 call. At the time, they saw a favorable valuation arbitrage for US listed technology companies versus those listed on the ASX. During Life360’s 2020 year end call on February 24th, managed said the company had received inbound interest from both strategic acquirers and financial acquirers seeking a US listing. The company also noted they see potential acquisitions of smaller insurance players.

Management

CEO and co-founder Chris Hull is an Air Force veteran with a BS in Business from UC Berkeley. He currently owns 6% of the company and is paid a $300k base salary with an annual bonus capped at $150k based on MAU growth, NPS score, Paying Circle growth, and revenue.

Former president and co-founder Alex Haro left the company in January 2020 to start mymoneykarma. He holds 620k shares.

Russell Burke has been CFO of the company since May 2020. Previously he was CFO at several technology companies in the Bay Area and served in corporate finance roles at Sony Music and Napster as well as CEO of Weight Watchers Australia and New Zealand divisions. He has a bachelor’s in commerce from the University of Newcastle.

David Rice, COO, has been with the company since 2015. He has a BA in Economics and Japanese from UC Santa Barbra and an MBA from Harvard Business School. Previously, he worked as a consultant at Boston Consulting Group before working as a Product Manager at Yahoo and Microsoft, SVP of CBS Interactive, and Chief Product Officer at VEVO. He is paid a $300k base salary and has a $100k annual bonus target.

As we detail in later sections, we believe management’s capital allocation is strong. For many user-based companies, chief to evaluating capital allocation is their CAC and payback period targets/customer level IRRs. We will show how the company is able to command strong returns on dollars spent in R&D and CAC in later sections. Furthermore, we are fond of the discussion and commentary around pausing user acquisition spend during the pandemic. This leads us to believe management will not deviate outside their stated CAC targets, which we believe offers strong returns.

Historical User and Top Line Metrics

Historical MAUs, US & International:

Exhibit 2: Life360 Historical MAUs by Geography

Historical Paying Circles, US & International:

Exhibit 3: Life360 Historical Paying Circles by Geography

Competitive Landscape

Consumer facing SaaS is not a great business and generally has low barriers to entry, a limited customer lifecycle, and in the case of Life360 no network effects. We believe the greatest perceived risk to the company is competition from big tech or a well-funded startup. Nonetheless, we also see Life360’s new offerings as encroaching on point solutions from legacy providers. As such, a section dedicated to exploring these competitive threats and opportunities in more detail is warranted.

Our view of big tech will focus on how have big tech companies offered similar features in the past, the value of those substitute products to the average parent, and possible product roadmaps.

Our view of competing point solutions will focus on the value Life360 creates with its bundle, if these substitute products are already included in other bundles (and, thus, would not present a strong value proposition by Life360 to families), and any business model improvements Life360 could benefit from by offering these products. We believe that in areas where Life360 has feature parity with competitors, it can take share given its lower price point and bundled value proposition.

Big Tech

We see Apple as the biggest threat to Life360. Apple discontinued Find My Friends with the release of iOS 13 replacing it with built-in functionality on iMessage and the Find My app to share your location. For parents wanting to monitor their kids, this requires children to opt-in to sharing their location indefinitely and gives them the option to stop sharing their location on-demand. Apple’s functionality is limited and currently does not offer driving reports, crime reports, and place alerts that are available on Life360’s free version. For many parents, we believe Apple’s location sharing features satisfy the requirement for an occasional check-in on their kid’s location.

For teens, we now believe Life360’s ghost location feature, which allows parents to set up a geofenced perimeter and only displays the teen’s location if they breach the perimeter, is superior to Apple’s integrated offering.

In the future, Apple could decide to integrate competing features into an AppleCare or its AppleOne bundle. An Apple for Parents standalone app would include all generic and easy-to-code features such as location tracking, driving reports, place alerts, and screen time monitoring. Apple would likely offer this service for free in effort to encourage greater adoption of its ecosystem for the entire family unit. In addition, the optics of helping parents protect children plays well with its privacy-first branding.

On Android, Google has built its location sharing functionality into Google Maps (this was on the now discontinued Trusted Contacts app previously). Like Apple, Google’s offering lacks many of the key features found on Life360’s free version. We see less competitive threat from Google given the lack of stated strategic initiatives around privacy and user protection.

Microsoft’s Family Safety app is the closest product to Life360. Family Safety gives parents location tracking, weekly activity reports on kid’s screen time, content filtering, ability to set screen limits, and a place to create calendars and plan vacations. The app is poorly reviewed at 2.7 stars and is not on any category’s top app lists. Like other offerings from big tech, it does not have driving reports, location alerts, or crash detection alerts. We find other appealing features Microsoft offers are absent on Life360, however (and would like to see Life360 implement these in the future). Screen monitoring, reporting, and the capability to set time limits on certain apps is excellent for parents of children all ages. Life360 acquired ZenLabs, a screen time management application, for $1mn and 130,000 in shares and plans to integrate their technologies into the app. Furthermore, management mentioned that they were monitoring Microsoft’s implementation of screen monitoring on the Q1 2020 call. We also find the integrated calendars, grocery lists, communication, and planning features found on the Family Safety app as strong features that create greater switching costs. In short, a single source of truth on family activities in the cloud is a strong value. Not only do these features allow for everyday annoyances to be easily automated (a child no longer has to constantly ask mom what’s for dinner; instead, they can just look at the Dinner Calendar on the app or ask Alexa), they can lead to better outcomes (there is a better chance you remember to Venmo the coach for a child’s activity if the child adds it to a To-Do list in the app). Going further, similar beta features Life360 is testing such as a Document Locker for storing medical records and other important documents provide a better user experience and again increase switching costs.

Facebook offers location sharing in Messenger. However, we believe they are more focused on broader social networking than on family monitoring. Additionally, we feel as though new products entries by Facebook into the family location monitoring arena would see little adoption given parents are less likely to allow their child on Facebook at age 12 than on a location point solution like Life360.

Overall, we believe the relegation of location sharing features from standalone apps to features of other apps by big tech is a positive for Life360. Parents wishing to do more than just the occasional check up on their child’s location should see immense value in Life360’s feature set.

Management is often questioned on competitive threats in earnings calls and has given several comments on the subject. The prospectus noted that new generic location sharing services from larger platforms increased knowledge of these solutions and is a major factor is driving downloads of Life360. Additionally, management specifies that the biggest risk is big tech designating these features as a strategic priority and as such they devote more resources to the project. In various earnings calls, they mention watching this closely. During the Q1 2020 call, management stated they were keeping an eye on Microsoft’s rebranded Family Safety product.

Lastly, for families who use both Android and iOS, a third-party solution is required as Apple’s Find My app is not available on Android.

Point Solutions

Life360’s investor presentation claims assembling the Platinum package piece by piece would cost upwards of $250/month. The company says it employs its software infrastructure and low CAC to offer similar coverage to many point solutions at a cost that is a fraction of the sum of the parts.

There is an argument to be made that if Life360 can offer the same benefits at a lower price point and message this to customers effectively, this is an immense value creating opportunity for all parties. Not only would Life360 expand its TAM to all households, it would enjoy the superior customer retention characteristics of these solutions. We explore the quantitative impacts this has on customer lifetime value in later sections, but first it is paramount we see where Life360 has feature parity and whether customers already receive this coverage as components of other bundles. We cover four features in this analysis: identity theft protection, phone protection, roadside assistance, and SOS help alerts.

Life360’s chief competitor in identity theft protection is LifeLock (NASDAQ: NLOK) though it also competes against Costco’s $9/month/person add-on for Executive Members ($14 for Gold Members), IdentityGuard ($15/month/family), and Identity Force ($32/month/family). We believe the main features customers value in identity theft are: $1mn in identity theft insurance, credit monitoring, 24/7 specialists to deal with issues, and data breach alerts.

We find that all these services offer $1mn of protection at their highest tier with similar coverage (LifeLock’s highest tier includes more legal coverage), 24/7 live customer support, credit monitoring, and dark web monitoring. The core value proposition, being covered against identity theft and having access to a swift response, is strong for both the Gold ($25k in coverage – similar to LifeLock’s $12/month tier) and Platinum ($1mn in coverage – in line with Lifelock’s $34/month tier) tiers and has high perceived value by the customer. In short, we believe that Platinum and Gold pay for themselves given similar coverage. Additionally, Life360’s upcoming free, lite version of its identity theft product should help in acquiring free users that later convert and provides the company a clear funnel advantage against peers. It is important to note that we do not see the technical side of running an identity theft and monitoring business to be overly complex as it is largely basic web scraping.

We see value in the two facets identity theft protection provides Life360: first, it increases Life360’s household TAM; and second, the retention metrics for identity theft are significantly higher. Today, Life360 is largely recognized as a location monitoring apps for parents. Parents without children old enough to have a phone, empty nesters, those who do not see value in tracking their child’s every movement, and parents who churn after their child graduates high school or college have little reason to download or keep using the app. With family identity theft protection, Life360 can increase its TAM of relevant US households from 33mn to 81mn9. Furthermore, Life360 can remain relevant once you are an empty nester. This lengthens the maximum customer lifecycle from 10 years (child gets a phone when they are 12 and parents no longer need to monitor them post high school/college graduation) to the entirety of an adult’s life. More importantly, the customer behavior benefit identity theft protection adds to Life360’s customer lifecycle adds tremendous value to customer LTV. Currently, Life360 retains 59% of users after 12 months and 47% after 24 months. Per a LifeLock investors presentations from 2016, one year cohort retention from the was 78.4%, with 85.9% of those users retaining for a second year. This demonstrates the stickiness potential the identity theft product brings to Life360. As we discuss in a later section, we believe this retention behavior would increase customer level IRRs to 72% from 48% shown by legacy cohorts and increases the LTV/CAC to 4.5x from 2.82x, all else equal (we should note that the company should be willing to increase its CAC to acquire cohorts exhibiting this behavior; a similar 21 month payback period equates to a .7x lift in LTV/CAC). We see Life360’s relative feature parity, new acquisition channels directed towards messaging these new features, and LifeLock’s over 20mn members as a strong positive margin and revenue opportunity for Life360.

Life360’s stolen phone coverage competes against carrier add-on subscriptions. The company offers $100 in stolen phone coverage for Silver subscribers, $250 for Gold subscribers, and $500 for Platinum subscribers. Life360’s coverage is limited to one claim per year per circle and requires the user file a police report and claim. Users can make a claim through a dedicated email address.

Carrier device protection plans often cover above and beyond stolen phones. T-Mobile’s Device Protection and Protection 360 add-ons include hardware service, accidental damage coverage, and theft and loss protection. However, T-Mobile’s highest tier of service is $18/month for Tier 5 devices such as the latest iPhone and requires a deductible be paid ($249 for a lost device and accidental damage). Life360 is uncompetitive on replacement phones as an iPhone would cost $249 to replace through T-Mobile and $499 through Life360. Additionally, Life360 only covers one reimbursement per family per year, opposed to T-Mobile’s per device coverage. Still, T-Mobile users are paying $216/year/device ($864/year to protect $4,000 in devices for a family of 4 on iPhones) and may find Life360’s lower priced $500/year in reimbursement credits more appealing at $240/year/family.

Verizon iPhone protection starts at $17/month for iPhone and multi-line customers can protect up to 10 devices starting at $50/month. Verizon goes above T-Mobile’s offerings with unlimited screen repairs, battery replacements, identity monitoring (not protection), tech coaches, and same day device replacement. Verizon has a $199 deductible on devices they define as Tier 1 such as the iPhone. Again, we view Life360’s offering as inferior and not of substitute quality but recognize that $600/year for family device protection is expensive.

AT&T starts their device protection pricing at $15/month for individual devices or $40 for a family of four. It has higher deductible payments but still provides superior coverage and allows up to 8 claims per year in its family tier.

In conclusion, while stolen device reimbursement coverage is an apple-to-oranges comparison against device protection plans from carriers, we see little substitute value in Life360’s offering. Instead, we view this feature as a nice added bonus and thus do not recognize any positive retention, TAM, or lifecycle benefits.

Life360’s roadside assistance provides coverage for towing (5 miles for Gold and 50 for Platinum), flat tire, lock outs, jump starting a battery, and running out of gas. It includes two service calls per family per year, only includes passenger cars and light trucks (no RVs), and only covers calls that are first initiated to Life360’s 24/7 support line (i.e. Life360 does not reimburse for service calls that are not started through the company).

AAA Roadside Assistance starts at $79.50/year. It includes the same features as Life360’s plans but is capped at 7 miles for a tow and covers four service events per year. Additional family members are $42/year.

State Farm and Allstate also offer roadside assistance products. State Farm offers similar coverage to Life360. While pricing is not publicly available, insurance review sites state it costs $12/year. Allstate has a $79/year and $149/year tier that include spouses and children under 18 who drive. In addition to similar coverage, it offers roadside assistance for RVs and motorcycles. Allstate’s lower tier covers 3 rescues a year with the higher tier covering 5.

Life360 is largely competitive in the roadside assistance category. We believe it provides a strong value proposition to customers at an excellent value. Accordingly, we believe the Gold and Platinum memberships are clear substitute products and can contribute to increased retention and TAM expansion.

The SOS Help Alert feature on Life360 is available for both free users and subscribers. Free users who press the SOS button can alert circle members and emergency contacts when they feel they need help. Gold and Platinum users have access to a 24/7 emergency dispatch feature; users who press the SOS button and confirm the situation on screen subsequently receive a call from an emergency dispatcher. Additionally, the 24/7 hotline can be utilized for disaster response, medical assistance, and travel support.

Noonlight, a safety app claiming to protect 2 million users, offers a similar SOS button functionality. Furthermore, it allows for emergency data to be stored such as blood type and medications taken. Noonlight has 3 call centers and boasts 100% coverage in the US. The company utilizes a freemium model which includes most features for free. For $10/month, the company adds crash response, a feature free on Life360.

Although there are other competitors, given a large point solution offers this functionality for free, we do not recognize any benefit to Life360 in terms of high perceived value of the feature, potential TAM expansion, and improved retention dynamics.

Given these competitive attributes, our analysis suggest users would otherwise pay $200-490/year to reassemble key features for $120/year on Life360s Gold subscription and $240/year for the Platinum subscription. While this differs materially from managements $3000/year commentary, we still believe Life360’s new features present immense value to the customer and the company’s unit economics and customer LTV.

Direct Competitors in Location Tracking

Life360 experiences intense competition in its family location and driving monitoring application. Overall, we see feature parity or better in Life360’s solutions and note that these features are free. Given Life360’s prominent positions in the Apple App Store and Google Play Store we believe it possesses a strong advantage against these competitors.

Geozilla, the company’s main competitor, offers crash detection and location sharing. Its premium service is priced at $15/month. The company’s app is not ranked on the App Store which we believe is due to Life360’s superior feature set in its free tier.

iSharing, an app focused on tracking capabilities only, provides place alerts, location history, panic alerts, and communication features. The app is ranked 125th in the social networking category of the Apple App Store and is well reviewed.

Lastly, there are many generic “find my friend” location sharing apps on both the Apple App Store and Google Play Store.

Common Concerns with Life360 and other New Age, Consumer-Facing Business Models

Hated Narratives

As an aside before we analyze the numbers on Life360, we believe it is fair to look at the way investors should view new-age, consumer-facing companies. Our analysis will focus on companies that own their content/offering and will not include aggregators such as Facebook and Google or two-sided marketplaces/platforms such as Uber, Airbnb, Booking.com, Shopify, and app stores which employ drastically different business models that are closer to that of a tax collector.

Consumer facing SaaS is not a great business. In general, there are low barriers to entry (the codebase for Tinder is much easier to replicate than the codebase for a cloud security company). Apps like Life360 that are focused on one specific group have zero network effects outside of word-of-mouth marketing. Moreover, the ease of switching to a competitor that can rebuild the functionality of your app in weeks is seamless for any family.

On the cost side, all consumer facing apps with a go-to-market strategy via the internet must pay some combination of Apple, Facebook, or Google. To acquire a customer for a consumer product, I market to them on a Facebook property. On the app, when the user choses to upgrade to a subscription tier, Apple or Google takes 30% of that revenue. And unlike Netflix, most consumer apps cannot create friction and demand you sign-up on Netflix’s website. These problems lead to a structural headwind to contribution margins. The 80% gross margin software play ends up with 50% contribution margins, a hoard of competitors rendering the service undifferentiated, and a customer who is more likely than not to cease being a paying customer within 12 months.

What we hope to show is that in any company that discloses user metrics and behavior, we can compute a return on invested capital for the company at a user level. We can compare this across companies and industries to compute to what degree a company would have to penetrate its TAM to be a compelling investment as users ebb and flow. If investors have a strong understanding of a company’s opportunity, TAM, ARPU, CAC, retention dynamics, funnel, and share dilution they can underwrite investments with higher confidence and a clear understanding of what must unfold for them to realize compelling forward returns.

With that, we can evaluate how a management team should spend and why consumer facing companies generally have a more difficult path. At the beginning of this report, we briefly mentioned the three levers a SaaS management team has in its hands to drive value: sales and marketing, research and development, and customer lifetime value. It is worth exploring them in more detail as we show how Life360 management utilizes these tools in our financial analysis.

Three Levers: Sales & Marketing

First, a management team spends to acquire users. Management’s go-to-market strategy here is crucial to their returns. For Life360, management chose a freemium model. Users find the app through word-of-mouth or paid acquisition spend by the company. Life360 is the beneficiary of strong word-of-mouth and shows for it with top 10 ranking in the social networking category of the Apple App Store. In the current funnel, users are acquired as free users; it is only in-app that Life360 meaningfully tries to upsell them on its subscription offerings through user education. In enterprise SaaS we denote additional spend on an already acquired customer as expand marketing spend (a customer success/account manager receives a commission for upselling them to the latest and greatest product or adds seats); in consumer SaaS expand spend is zero considering the only upselling costs are the friction induced by upselling banner ads in-app. Management also has a choice of marketing channel. Traditionally, this has been Apple Search Ads (the company did not begin Facebook advertising until February 2021, per Facebook Ad Library).

Furthermore, a company has a relevant TAM of potential paying users it can acquire. For Life360, this is US households with children under 18. Hopefully, the TAM is naturally replenishing. For Life360, we believe that households with children under 18 have rather neutral gross churn characteristics (that is for every family with that leaves the category due to a maturing child, a new one joins with a baby).

Three Levers: Research & Development

All companies participate in research and development to create new products and improve existing products in effort to either increase the monetizable surface area or improve the current user experience (leading to increased usage and retention).

For example, and enterprise SaaS company could introduce a product in an adjacent market hoping its more integrated offering entices existing customers to replace their existing point solution with the company’s new product. Also, a consumer SaaS company could add a new free feature that its users receive from a competitor at some monthly price. The management team decides that this feature is worth the increase in user retention behavior the company will experience and possible share gains from the competitor that flow to its bundled offering.

Three Levers: Customer LTV

Having identified where, who, through what channels a management team can spend on, and what features a team has or can add to monetize our user base, we can decide how much we are willing to pay for a user and what we can do to increase their lifetime value.

We need to understand how a user participates in the funnel before we compute a customer lifetime value. For Life360, the company acquires free users who bring their family onto the app. Life360 engages in in-app advertising for its paid solutions (and shows paid features to free users) and some convert to paid subscribers (historically, most subscriber starts are from existing free users). Additionally, some subscribers in lower tiers see value in offerings in higher tiers and expand their spend. In this funnel, Life360 has one tool: spend money to acquire free users. We analyze how much Life360 pays for a free users and its imputed cost on a paid user (i.e. how many users converted from free to paid) in the next section.

The average revenue of a user is dependent on how a typical user retains over their lifetime and the product choice of that customer. A subscriber pays a certain monthly or annual fee to the company depending on their subscription level; we examine the weighted average subscription price historically to gauge what tier the average user pays for. We then chart the average user of the average subscription over the expected lifetime of the average user. User retention typically flatlines (experiences limited churn) after 2-3 years. That is, a paying user of Life360 will likely spend their entire lifecycle (we model 90% annual retention after year 2) with Life360 if they are still with the company after two to three years. A paying user of Life360 at t=0 is 59% likely to remain a paying user after one year, 47% after 18 months, and 37% thereafter (i.e. the average user for a $100 subscription is spending $37 in year 3). Life360’s maximum lifecycle for its main use case is 10 years since a child receives a phone around the ages of 10 to 12 and the location tracking features lose their value after a child has graduated high school or college.

Next, we need to realize the contribution margins of this revenue. Life360 has several cost buckets that dictate the contribution margin of a paying customer. First, it has typically gross margins which are close to 85-90% for paying users. Second, the company pays to support free users; this brings contribution margins close to 65-70% (consolidated technology costs and customer support/benefits are ~20%). Last, the company pays Apple/Google for the privilege of being able to sell in-app subscriptions on their device. This is a 30% toll on revenue in the first year of the subscription and 15% thereafter. On a blended basis, Life360 generates 40-45% contribution margins on paying subscribers.

Our north star metric is Customer Level IRR. Essentially, we wish to know the IRR of contribution profit for the average customer given the cost the management team took to acquire them. This IRR can be compared across companies and industries given we understand the behavior of the average customer and the price to acquire them. By subtracting R&D spend from the Customer Level IRR we can get generate a SaaS adjusted ROIC calculation for evaluating management (traditional metrics to measure ROIC are ineffective in measuring SaaS businesses; there are much better ways to calculate an actual SaaS ROIC with a traditional NOPAT derived method and S&M, R&D and capex as invested capital drivers). We believe this is method helpful in new, customer-based business models that may not be accurately be represented by a GAAP balance sheet. Furthermore, Incremental Customer Level IRRs can help investors compare new initiatives to improve retention, monetization, or the funnel against historical levels to understand differences in management’s return on capital.

Consumer SaaS and the Customer Relationship

Now that we have defined how we model management’s capital allocation and return on monetizing the customer relationship, we can begin to show the differences between business models and why consumer-facing SaaS is so difficult.

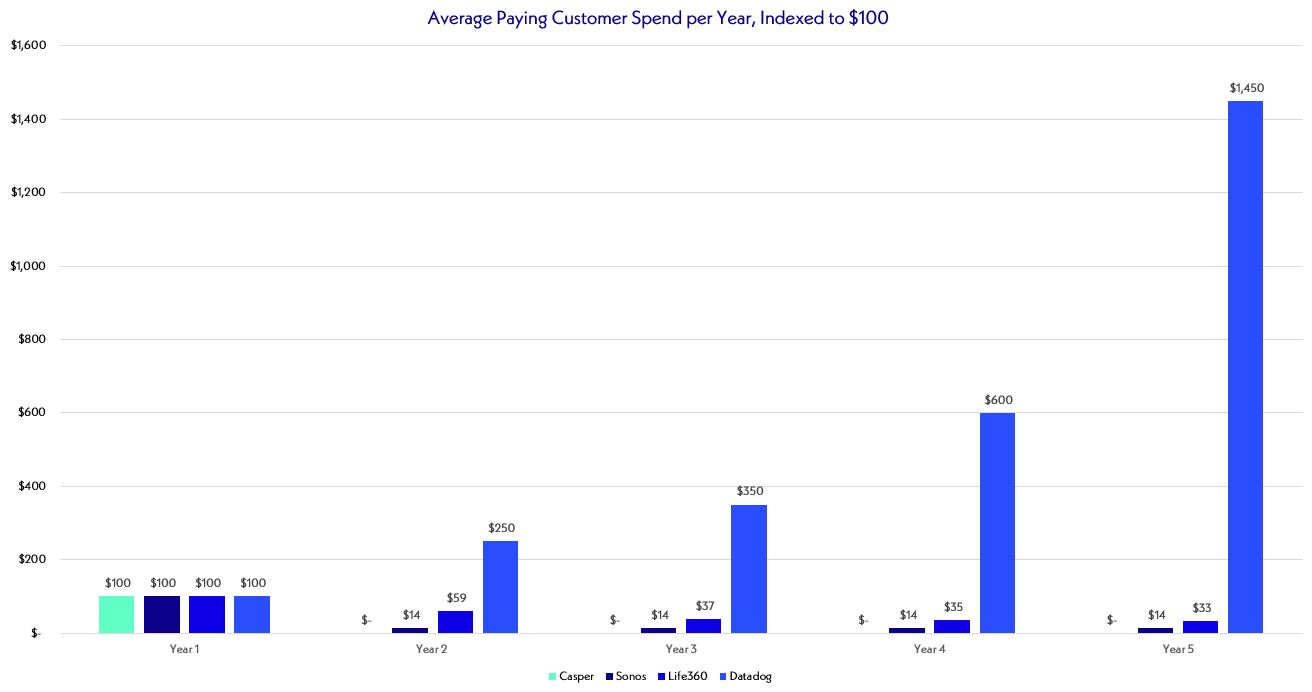

At the very least, the customer relationship in consumer-SaaS is much better than other DTC “internet branded” companies that, if the company has done a good job, a customer will reorder a mattress every 7 years (maybe you tell a few friends or furnish your entire house with the company’s mattress). In consumer SaaS, the consumer relationship is a touch better. On average, the majority of new customers that paid for a subscription during the year will not be a paying customers last year. In comparison, the best enterprise SaaS companies dramatically expand spend every year through new products or through companies adding additional seats.

Despite these unfavorable characteristics versus enterprise SaaS, management teams at consumer facing SaaS companies can still generate returns on capital at and or in excess of B2B SaaS companies. In fact, less competition in a space can lead to outsized returns.

We can measure the revenue potential of a specific customer or cohort for any business that discloses barriers to entry. The following chart shows how the average customer in a traditional DTC business (Casper), DTC ecosystem business (Sonos), Life360, and an enterprise PaaS company (Datadog) spends with the company when first year spend is indexed to $100:

Exhibit 6: Average Spend for a Consumer Facing Product, Consumer Facing SaaS, Enterprise SaaS Customer Over Time, Indexed to Year 1 Spend of $100

Methodology: From SEC filings: Casper (NYSE: CSPR) is mostly a joke; Sonos (NASDAQ: SONO) assumes that product mix among existing households and new households spend is equal; Datadog (NASDAQ: DDOG) is from the cohort chart on the prospectus for the 2013 Cohort; Life360 (ASX: 360) is from prospectus cohort charts and new ARPPC disclosures

Although many of these differences are related to the industry and you naturally pay more to enjoy Datadog’s revenue characteristics, the golden age of investing in mobile app companies that sell subscriptions is perceived to be long gone (see Spotify’s struggles until the podcast narrative). Recall at the beginning of this report on the falloff in VC money into consumer SaaS post the mid-2010s. These are fundamentally challenged business models as they experience low barriers to entry, little to no network effects, and a limited customer relationship lifecycle.

We see potential in Life360’s ability to escape these constructs. Identity theft, roadside assistance, stolen phone coverage, and other features drastically improve switching costs and noticeably lengthen the customer relationship. As we transition to a qualitative analysis of Life360, its current industry, and its new industry, we hope to show that the business model is rapidly inflecting towards a stickier and more defensible product – and one that investors can buy at a reasonable price.

Total Addressable Households

US Households with Children Under 18

We view Life360’s TAM as US households with children under 18. Because a family pays as a unit and not by user, it is relevant to look at the average number of users in a Paying Circle (Life360’s definition for a family that is a paying subscriber). From the IPO prospectus, we impute 3.45 users per Paying Circle in the US. In addition, Life360 is only relevant in its legacy form to households with children that have a phone and are still dependents; the core location and driving monitoring functionality is applicable only to parents of children aged 10 to 22 – depending on when the child receives their first smartphone.

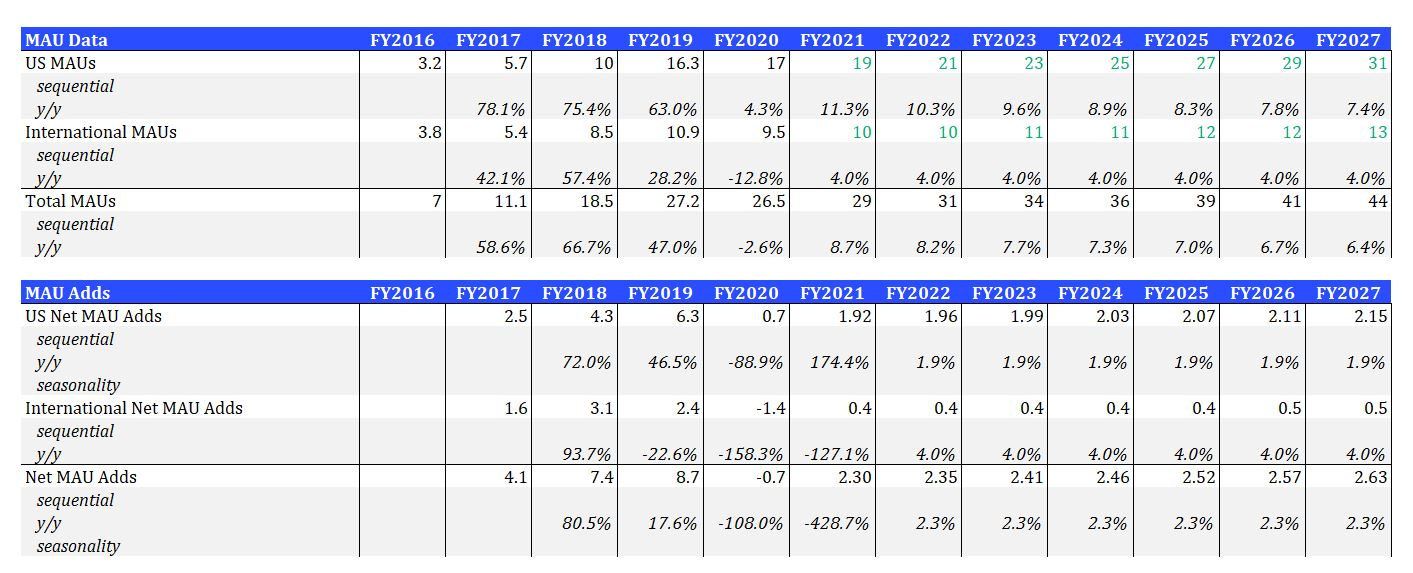

The US Census website provides a time series on US households with children under 18. In 2020, 33.5mn US households had children under 18. Over the last 10 years, the number of US households in this category has hovered between 33mn to 36mn. We have charted Life360’s implied capture of free households and paid households in the US since 2017. To count free households, we take US MAUs divided by 3.45 members per family. For paid households we take Life360’s reported US Paying Circles. We then divide both these numbers to understand how their share of households under 18 have tracked over time.

Exhibit 7: Life360 Imputed TAM Capture; US Household Data from US Census

We witness several important trends. First, Life360 has steadily increased its penetration of US households with children under 18 – increasing market share from 4.9% in 2017 to 14.7% in 2020. Second, COVID caused a significant deceleration in growth. We believe the slowdown in 2020 was entirely COVID related as there was little value to be had in location tracking and driving reports during school and economic shutdowns. We hesitate to call Life360 a reopening play, but in many regards growth is dependent on it. Third, conversion of free households to paid households (measured by dividing the number of paying circles by total US households on the platform) has been steady around 14%. We drive our projections by toggling these levers (US household free penetration growth, total conversion to paid, and TAM growth).

We expect the growth of Life360’s TAM to be relatively muted but recognize the need to account for the inflows and outflows of families in this category. At some scale penetration level, Life360 will need to constantly reacquire new households with children given the limited lifecycle of a household. We believe that the TAM is naturally replenishing and thus exhibits neutral churn characteristics. That is, for every household that exits the category due to their last child turning 19-23, a new household has a child. In looking at scale margins, we account for the fact that if Life360 is unsuccessful in its new measures to lengthen user lifecycles beyond a child’s teenage years, it will have to replace 10-15% of its MAUs annually just to breakeven on user growth.

We believe the biggest risk to Life360’s business is that is has already captured the TAM for its core tracking features. As previously discussed only a certain percentage of parents want the ability to religiously track their kids. One BYU study found that only 20% of mothers and 12% of fathers were “controlling helicopter” parents10. Again, we believe that for the average parent who wants to track location a few times per year, the location features native to Google and Apple devices are good enough substitutes to Life360’s free version. However, we still believe Life360 is under-indexed among parents and see runway toward 22% to 28% household penetration long term given its current and future free offerings.

Optionality and TAM Expansion

A key component of our thesis – and reason for the detail we devoted to canvassing the competitive landscape for point solutions – is Life360’s new offerings found in the Gold and Platinum subscription tiers will lengthen the relevant period a family finds value in the app leading to longer user lifecycles, higher customer LTV through better retention and a reduced requirement in replacement CACs, and an increased TAM.

In fact, we see Life360’s strong value proposition in identity theft protection, roadside assistance, stolen phone coverage, and 24/7 help as increasing TAM from 33.5mn potential paying circles to the 80.8mn US households who make over $50,000 per year11. Additionally, Life360 can capture this opportunity with a GTM strategy focused on winning users wanting an inexpensive and easy-to-use option for these products. No longer will the company be limited to selling these products only in-app to parents who are users because they value the location features. If Life360 can execute on a strong DTC marketing campaign with proper education on its offerings, the runway for paid user growth is much greater than its legacy business.

Cohort & Customer Behavior

User Acquisition & Retention of Free Users

Life360’s paid funnel works by acquiring a free user – who subsequently onboards their family on the app – and then attempting to upsell them in-app. We evaluate management’s return on user acquisition investments by determining the cost management pays to acquire a free user, the historical retention pattern of a free user, the historical chance of them converting to a paid subscription, and the historical retention patterns of a paid user.

Due to the absence of gross user adds in a period, we have little data to understand the true cost of acquiring a user. Net MAU adds in a period encompass gross adds in the period less churn from all cohorts. Additionally, in a family, only the first user is a paid acquired user as users 2+ are added organically. Given these challenges, it is difficult to understand the true cost of a gross add over time (we are provided some numbers in the prospectus in addition to commentary around management’s target payback period). Our analysis thus shows a CAC for net MAU adds in a period.

Management separates user acquisition spend from generic sales and marketing spend. Generic sales and marketing includes the salaries of those in the department and brand marketing. We look at both blended CAC and direct CAC.

The only time we are given gross user adds is for New Registrations in 2017 and 2018.

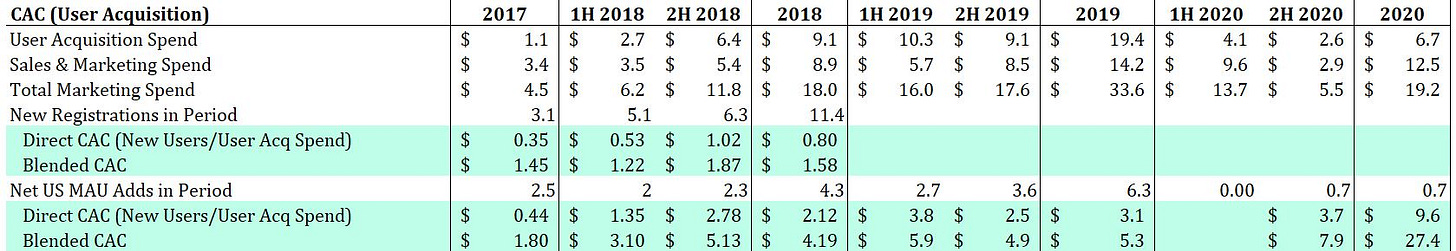

Exhibit 8: Life360 Historical CACs

When gross user numbers were provided, Life360 was able to add a user for around $1.50. On a net MAU basis, this number is closer to $5 when accounting for all marketing spend.

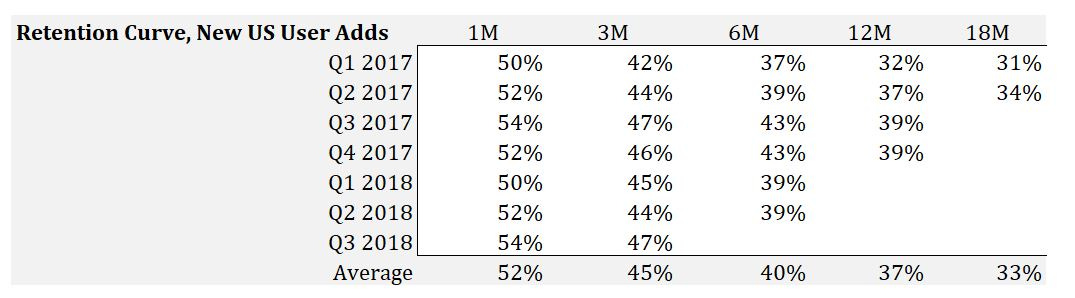

With a free user on the app, Life360 needs to retain them. A rough estimate based on pixel counting the retention of free cohorts from page 36 of the prospectus provides us the following data:

Exhibit 9: Life360 Historical Free User Retention Chart by Cohort

We see that for the average cohort of free users Life360 adds, only 52% retain after 1 month 37% after 12 months, and 33% after 18 months. As we discussed in a previous section, this is one reason why consumer facing SaaS is a tough business: paying to acquire a free user who is unlikely to stay around and then trying to upsell them requires exceptionally low CACs given the funnel characteristics. Businesses with undifferentiated offerings and easy-to-replicate code bases do not make sense as they reach scale because the cost of needing to replace churning users eats into the immense operating leverage typically realized from cohort stacking land marketing spend at scale.

Paying Circle Retention

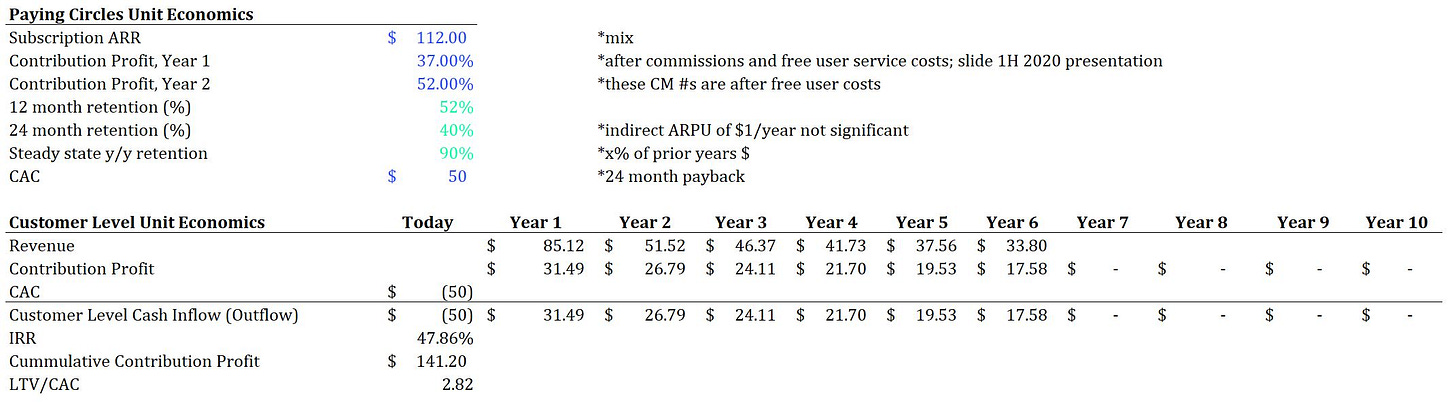

Free users can convert to a paid subscription (as we showed in Exhibit 7 this is around 14% of monthly active households provided there are 3.45 MAUs per household). These paid users historically came from upsells of free users and the cost to acquire a paid user is roughly the CAC of a free user / average retention of that free user / 14% chance of subscribing. On average we calculate that Life360 pays ~$50 for a Paying Circle add. Management has commented that the target payback period for an average user is 24 months or less. We find that this lines up quite well with our $50 average user acquisition cost assumption.

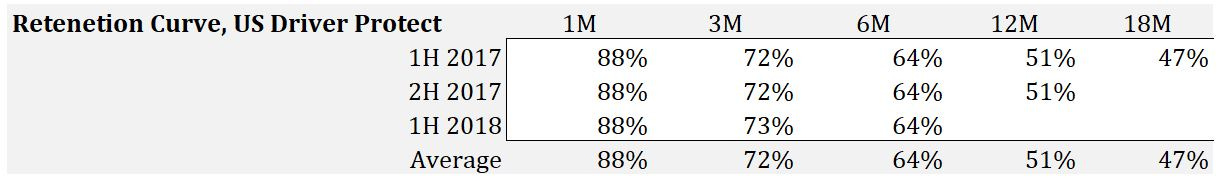

Turning to churn, Life360 experiences Paying Circle retention metrics that are above free user retention metrics. We are provided two charts (one from the prospectus and the other from the 1H 2020 investor presentation), but both reflect the retention of the discontinued Driver Protect subscription.

Exhibit 10: Life360 Historical Driver Protect Retention by Cohort; from IPO Prospectus, page 38

Exhibit 11: Life360 Historical Driver Protect Retention by Cohort; from 1H 2020 Investor Presentation, slide 11

Retention for Life360’s Driver Protected averaged close to 51% at 12 months (management said in the prospectus this was 59%; however, our analysis is much cruder given we have to blow up screenshots of these small charts and pixel count to extract the data) and 40% at 24 months. The yellow shading of 12-month retention for the March 2019 cohort reflects the impacts of COVID. In comparison with other consumer facing freemium SaaS companies, Life360 experiences similar churn. Spotify and Pandora see low to mid 60s retention of paid customers after one year (these are industry leading numbers; Amazon’s paid music product has low 20% one-year retention)12.

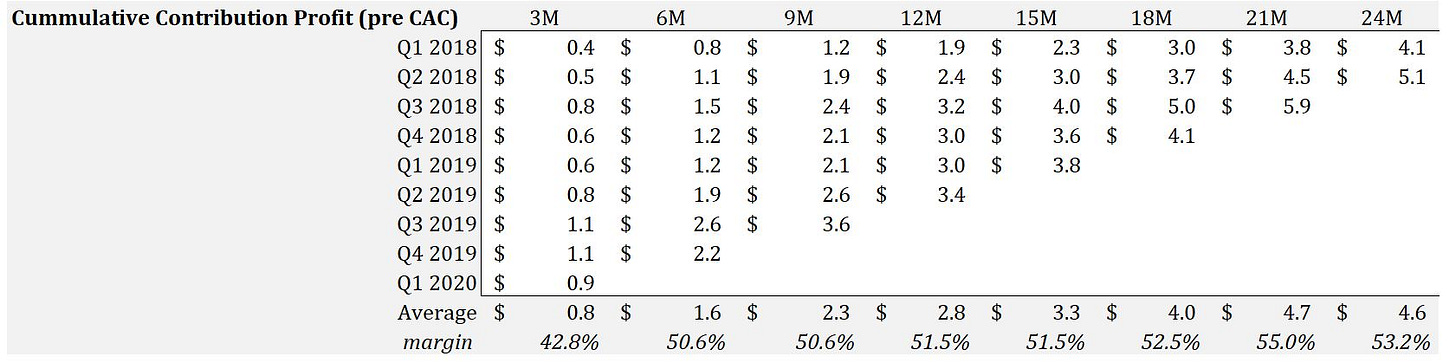

Life360 also measures cumulative Paying Circle revenue, contribution profit, and spend by cohort. This cohort view, provided in investor presentations, allows us to check against our user level computations.

Life360’s cumulative revenue for a Paying Circle Cohort over time:

Exhibit 12: Life360 Cumulative Revenue per Driver Protect Cohort

Life360’s cumulative contribution profit for a Paying Circle Cohort over time:

Exhibit 13: Life360 Cumulative Contribution Profit per Driver Protect Cohort

Life360’s payback period by month achieved for a Paying Circle Cohort:

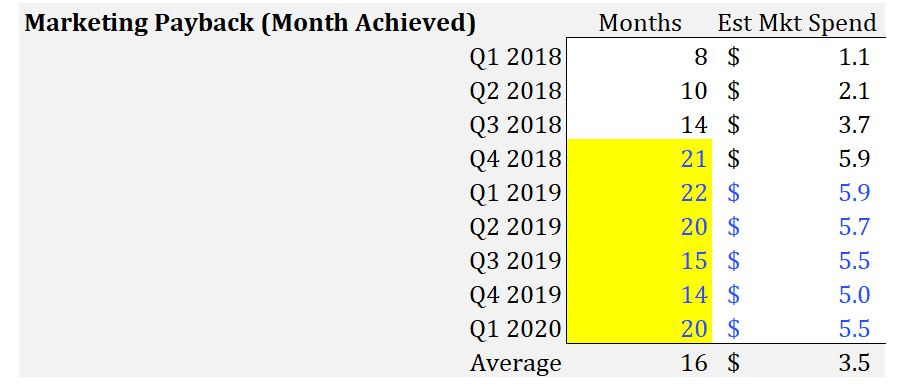

Exhibit 14: Life360 Payback Period by Month Achieved per Driver Protect Cohort; cells in yellow are based on the slopes of cohorts that have not achieved payback yet; blue numbers are estimates based on those slopes

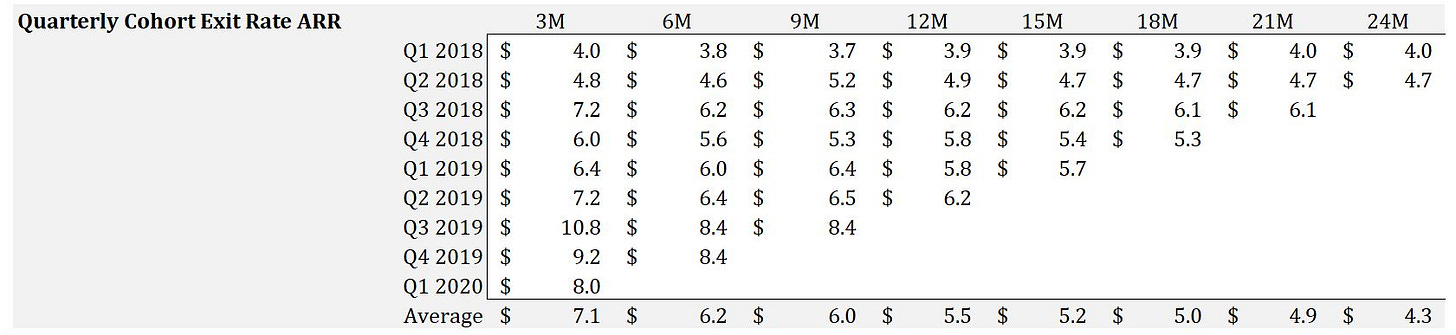

We annualize the exit rate ARR values and measure cohort net dollar retention through time:

Exhibit 15: Life360 Rough ARR Exit Values per Driver Protect Cohort

Exhibit 16: Life360 Net Dollar Retention Metrics per Driver Protect Cohort

As we explain in the cohort level IRR calculations in the next subsection, this data is in sync with our customer level view of the funnel and corresponding IRRs. One of the key risk factors, increasing CACs, transpired in 2019 and 2020 but are below management’s thresholds. We will closely monitor these trends as ballooning costs would suggest the company is tapping out its relevant TAM for its core location tracking features, seeing competition in app store search ads, or has less product-market fit with newer cohorts who are not as aware of the brand.

Customer Level IRRs

In the Common Concerns with Life360’s business model section, we explored how to evaluate a management’s teams return on capital in a user focused business and the tools they have at their disposal to generate acceptable returns.

We make several additional assumptions to those supported by the data in the previous subsection. We assume the average useful life for those that stay on the app for over 2 years spend 6 years with the company though heavier users will find the app useful for ten to twelve (this change alone only raises IRRs by 3%, but lifts LTV/CAC to 3.91x from 2.82) and churn at a 10% rate annually after year 2.

Exhibit 17: Life360 Subscriber Customer Level IRR, based on revenue mix of new subscription pricing

Given the provided cohort data, we see these returns apply to the cohort (as we would assume):

Exhibit 18: Life360 Subscriber Cohort Level IRR, based on historical data in 1H 2020 Investor Presentation